What is a NonProfit Accounting Software, and How Does It Work?

Nonprofit organizations have an increased responsibility to satisfy regulatory requirements and remain transparent with donors. As a result, an effective accounting system is necessary for both accuracy and accountability. This level of transparency can be achieved by utilizing nonprofit accounting software.

What is Nonprofit Accounting Software?

An efficient accounting system is essential for nonprofit organizations, but what is nonprofit accounting software, exactly? Nonprofit accounting software helps not-for-profit businesses and organizations effectively manage funds with automated financial reports. These programs are specifically tailored to nonprofit accounting procedures and requirements.

What is nonprofit accounting?

Nonprofit accounting is the process of planning and reporting the finances of nonprofit organizations.

The distinctive nature of nonprofit accounting processes presents the need for specialized software. While standard accounting programs produce similar reports for other business models, nonprofit requirements extend beyond these generic features.

Nonprofit accounting is much more involved, and, as a result, many basic accounting reports often contain irrelevant information, and in the worst cases are inadequate to produce the detailed reports that must be disclosed to donors and the IRS.

For instance, an accounting software program geared toward for-profit businesses will generate income reports that display the company’s net earnings at the end of each year. Not only does this not apply to nonprofit organizations, but these programs do not include the additional reports necessary for explaining how donor funds are being used in a clear and easy-to-understand manner.

Nonprofit accounting vs. regular accounting

Detailed budget tracking is the primary difference between nonprofit accounting software and other products intended for revenue-focused businesses. Instead of utilizing standard accounting tools to manage profit margins and increase earnings, nonprofit organizations require customized features to maintain a clear audit trail that displays how funds are managed, spent, and allocated. This process is known as fund accounting.

Fund accounting aims to split incoming revenue into relevant budgets and track spending from each source with detailed reports.

Through fund accounting, the nonprofit model emphasizes budgets and proper allocation of funds rather than earnings. With practical accounting tools, organization leaders can distinguish expenses and remain transparent with donors.

Overall, nonprofit accounting software helps program managers meet unique financial reporting requirements and effectively manage grants and other restricted funds.

Who Needs Nonprofit Accounting Software?

Nonprofit organizations and even for-profit businesses that have a nonprofit or charitable department require specialized software to manage budgets and track the allocation of funds adequately. Securing donations and the distribution of grant money comes with the expectation of keeping detailed and transparent financial records. Generic accounting programs can not address these challenges, which may result in the mismanagement of funds, or at the very least inadequate reporting for tax and transparency purposes.

Accounting software built with the nonprofit business model in mind features tools for convenience and accuracy where generic solutions miss the mark.

How Does Nonprofit Accounting Software Work?

A nonprofit budget is split into three categories: restricted, temporarily restricted, and unrestricted. Restricted funds can only be used for a specific program or project. They are donated to the organization for that purpose alone and cannot be used to pay for miscellaneous expenses.

Temporarily restricted funds must be allocated to one program or project for a specified period. After these restraints have been satisfied, the funds become unrestricted. Nonprofit leaders are free to use unrestricted funds as needed. This budget may be allocated to expanding the mission or focusing on areas of the organization that require general improvement.

Nonprofit leaders need to separate funds and allocate each budget to the appropriate areas to avoid legal consequences. This is where nonprofit accounting software comes in. It adds several dimensions beyond revenue and expense tracking offered by generic accounting programs.

Nonprofit accounting software makes reporting easier by organizing funds with the following forms and statements.

Setting a nonprofit budget

The nonprofit budget is a planning document that’s required to establish spending for the year. It’s an estimate of expected revenue and upcoming expenses. This sheet gives insight into where money will be allocated from each funding source.

Income statement

The income statement for a nonprofit organization is also known as the statement of activities. This document categorizes funds according to budget restrictions and displays revenue and expenses for accurate net asset calculation.

Statement of functional expense

Similar to the income statement, this document separates expenses by category. Funds allocated to programs, fundraisers, and administrative costs are reported on this sheet. Keeping an organized record of how funds have been distributed throughout the year is helpful for Form 990 filing.

Cash flow statement

The cash flow statement reveals the funds available for the organization to use for expenses at any time. This is especially useful for nonprofit leaders to understand which funds are accessible according to restrictions.

Balance sheet

The balance sheet is a statement of a nonprofit organization’s financial position. It is a detailed report on the overall financial health based on revenue and spending.

Accounts payable is especially important when it comes to nonprofit accounting. In addition to calculating payments for goods and services, dispersed grant funds must be properly tracked and accounted for. Nonprofit accounting software provides simplified reporting for distributed payments in line with tax obligations.

Form 990

Tax-exempt organizations are required to file Form 990 every year for proof of compliance. Detailed reports are essential for timely and accurate filing. Nonprofit accounting software helps program managers meet these requirements.

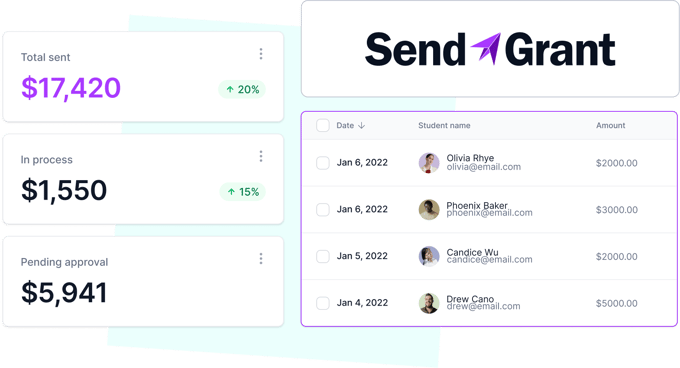

When to Choose SendGrant for Grant and Scholarship Payments

SendGrant is an accounts payable software product that addresses the unique needs required for grant payments for nonprofit organizations. Grant and program managers can use SendGrant to securely send funds to recipients with detailed reporting features for tax requirements. It allows organization leaders to establish guidelines for the proper use of funds, providing transaction logs for convenient tracking and dispute resolution after the funds are dispersed.

The electronic transfer of funds minimizes human error and increases accountability for recipients. SendGrant provides an audit trail that notifies both parties of the receipt of funds, which can’t be achieved through alternative payment methods such as wire transfers and mailed checks.

Nonprofit managers can take advantage of SendGrant’s convenient workflow incorporating several approvals and checks from designated accounting staff members. If you’re interested in automating your grant and scholarship payments, click here to get started with SendGrant today!

About the author

Founder and President of SmarterSelect. Responsible for company, product, and marketing strategies and execution.

WebsiteRead more posts by this author.